The study shows that the COVID-19 epidemic ignited the increase in FAB spending in 2020 by accelerating digital transformations around the world, and the increase is expected to continue in 2021 as well.

Investments in 300 mm diameter chip factories will increase by 13% this year and even exceed the previous record set in 2018 and will also record another strong year in 2023, This emerges from an updated study by the SEMI organization.

The study shows that the COVID-19 epidemic ignited the increase in FAB spending in 2020 by accelerating digital transformations around the world, and the increase is expected to continue in 2021 as well.

“The COVID-19 epidemic is accelerating the sweeping digital transformation in almost every conceivable industry and reshaping the way we work and life,” said Agit Manucha, President and CEO of SEMI. “Expected peak expenses and the 38 new pubs reinforce the role of semiconductors as a bedrock of leading technologies that drive this change and promise to help meet some of the world’s biggest challenges.”

Most of the growth comes from the growing demand for cloud services, servers, laptops, games and technology in the healthcare field. Rapidly evolving technologies such as 5G, Internet of Things (IoT), vehicles, artificial intelligence (AI) and machine learning that have continued to increase demand for faster connectivity, large data centers and big data that have also contributed to the increase in demand.

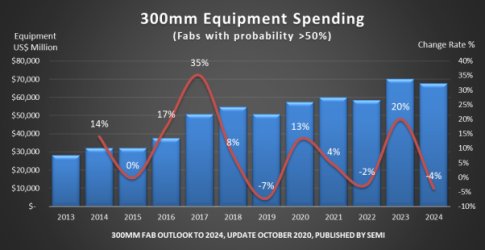

Growth in semiconductor investments will continue in 2021, but at a slower rate of 4% (annual). The report takes into account previous cycles in the industry, and therefore it also anticipates a slight slowdown in 2022 and a further slight slowdown in 2024, after a record $ 70 billion in 2023. See Figure 1.

Figure 1: Expenditure on equipment for the production of 300 mm diameter chip slices between 2013 and 2024

Adding 38 Fabs 300mm new

SEMI’s forecast for 2024 is that the chip industry’s capacity will increase by 38 300 mm plants between 2020 and 2024, a conservative forecast that does not take into account low – probability projects or rumors. In the same period, production capacity increased by 1.8 million slices and will reach over 7 million. See Figure 2. Of these, 11 of the plants will be established in Taiwan and eight in China. The chip industry will stand at 161 300 mm plants by 2024.

Figure 2: 300 mm capacity and pub count for 2015, 2019 and 2024

Increase in expenses by product segment

The memory chips make up the bulk of the increase in expenses of great 300mm factories. Actual investments and forecast show a steady increase of 8-9% each year between 2020 and 2023, with a stronger increase of 10% expected in 2024.

The contribution of DRAM and 3D NAND to investments in 300 mm plants will be non-uniform between the years 2020 and 2024. However, Logic / MPU investments will see a continuous improvement between 2021 and 2023. Power chips will be the most prominent segment in 300mm investments with growth of more than 200% in 2021 and double-digit growth in 2022 and 2023.

Growth in capacity and expenditure by region

China will rapidly increase its global share in capacity by 300 mm, from 8% in 2015 to 20% in 2024, reaching 1.5 million 300 mm slices in the last year of the forecast period. While non-Chinese companies will use much of this growth, Chinese-owned organizations are accelerating their capacity investments. These companies will account for about 43% of China’s capacity by 2020, a rate that is expected to reach 50% by 2022 and 60% by 2024.

Japan’s share of installed capacity of 300 mm continues to decline, from 19% in 2015 to 12% in 2024. The US is also expected to shrink from 13% in 2015 to 10% in 2024.

The largest regional investors will be Korea, with investments ranging from $ 15 billion to $ 19 billion, followed by Taiwan, which will invest between $ 14 billion and $ 17 billion in 300mm plants, followed by China, with investments of between $ 11 billion and $ 11 billion. $ 13 billion.

The steepest increases in investment between 2020 and 2024. The Europe / Middle East region will lead the group with impressive growth of 164%, followed by Southeast Asia with 59%, America with 35%, and Japan with 20%.

- ✅ Tropical Oasis multiple vitamin mineral has 100% RDI of 12 vitamins and minerals plus essential amino acids and herbs.

- ✅ 125 total nutrients including: 85 vitamins & minerals, 23 amino acids and 18 herbs

- ✅ 70 Colloidal minerals | 4: 1 concentrate | Great Tasting Formula

- ✅ Helps in maintaining health and energy throughout the day*

- ✅ Maximum absorption: liquid vitamins absorbed by your body up to 96% - compared to pills/capsules that are only absorbed about 18%.

- 100 Billion CFUs, Shelf Stable, 34 Strains: Our probiotic contains a shelf stable 100 Billion Cfu & 34 Strains per serving & 3 Trillion Cfu per bottle. We saw a need for high-quality supplements that actually work and stand by their claims, our probiotics comes with a Satisfaction Guarantee. Professional grade Non-Gmo vegan probiotics with No: Binders, Soy, Gluten, Milk, Egg, Wheat, Peanuts, Shellfish, Additives, or Preservatives.

- 100% Raw Probiotics, Organic Prebiotics And Digestive Enzymes: Our Dr Formulated probiotic is made with genuine prebiotics, digestive enzymes, and probiotics A complete once daily probiotic supplement.

- Doctor Formulated Probiotic Supplement: Our one-a-day whole food probiotic with digestive enzyme & prebiotic fiber is Dr. formulated for an optimal blend of ingredients

- Probiotics For Adults With 34 Strains: Our prebiotics and probiotics are High Potency and intended now for use by you a female and male adult. Acidophilus probio with pre-biotic pills including 34 symbiotic good strains, fungus, & absorb cultures. Lactobacillus acidophilus, casei, paracasei, salivarius, plantarum, bacillus, bifidobacterium lactis, bifidum, longum, saccharomyces, fermentum, and more see full ingredients below. Easier to take than powder, gummies, liquid, & pearls

- Assured Standard Of Quality & Safety: Made in the USA in a UL, GMP certified facility labs. Probiotic for women, probiotic for men, probiotic for adults - Gives 100 Billion Cfu - More than products of 3, 5, 10, 13, 15, 40, 45, 50, 60, 70, 80 Billion Cfu! Shelf stable non refrigerated platinum pro-bio-tic, pure no refrigeration pro-biotics, Lactobacillus acidophilus, ultra vegetarian probotics activated supplement assist advantage.

- 【Make sure this fits 】Use amazonconfirmrdfit, Enter your model.

- 【Easy installation】 - Easy installation, easy installation only 1 minute.

- 【AAAA Grade Natural rubber】 PTFE coated high quality rubber - quiet/clean/no trace.

- 【Guarantee】: 60 days free return, no worry, no risk, no problem.

- 【Quality】OEM standard, exact fit replacement of original rear wiper blades.

- THE LATEST SCIENTIFIC RESEARCH: Our development team stays up-to-date with the latest scientific research. With their findings, we continually introduce innovative new products and update existing formulas.

- THE FINEST RAW INGREDIENTS: Carlson proudly goes above and beyond required FDA testing regulations to ensure our customers receive only the highest quality nutritional supplements.

- THE STRICTEST MANUFACTURING TECHNIQUES: To protect the effectiveness of the nutrients found in our products, Carlson employs manufacturing techniques that avoid the use of excessive heat, moisture, and solvents to protect nutrient content.

- During the summer months products may arrive warm but Amazon stores and ships products in accordance with manufacturers' recommendations, when provided.

- Fragrance-Free day and night moisturizer for face and chest: provides skin with a daily dose of intense hydration that helps to fill in the appearance of lines and wrinkles and helps restore moisture for smoother, plumper skin

- This lightweight, non-greasy moisturizer delivers hydration and moisture to all skin types, including sensitive skin and absorbs quickly without leaving a sticky film, for smoother, nourished, younger-looking skin

- Proven results: Overnight, skin is nourished with moisture; In 1 week of using this face moisturizer skin feels smoother and in 4 weeks of use, wrinkles appear more filled in

- Replenish skin with Collagen: Gift your skin a daily dose of hydration from L'Oreal Paris anti-aging skin care, whether face lotion, night eye creams, or moisturizers with SPF, they provide your skin essential moisture to keep skin healthy

- Kickstart your routine; First cleanse with Revitalift Derm Intensives 3.5 percent Pure Glycolic Acid Gel Facial Cleanser, treat under eye with Eye Defense Eye Cream and hydrate day and night with Collagen Moisture Filler Moisturizer

- COLLAGEN PEPTIDES WITH BIOTIN: Collagen diminishes with age. Youtheory Mens Collagen Advanced with Biotin, Vitamin C, and Amino Acids helps replenish this vital protein to fight the effects of aging by revitalizing skin, hair, nails, tendons and ligaments

- HYDROLYZED COLLAGEN PROTEIN: Collagen is the main component of healthy joint cartilage, which acts as a cushion between bones. Our hydrolyzed formula is highly bioavailable which means it is easily and rapidly absorbed in the body

- THE BEST NATURE AND SCIENCE CAN OFFER: Feel good inside and out. We believe that health starts within by using the best wellness supplements on the market. Designed for men of any age – supplying high-quality collagen peptides to help counteract age-related collagen loss

- PREMIUM HEALTH SUPPLEMENTS: Find the best in you with an innovative line of health and wellness supplements that make you look and feel your best at any stage of life.

- THE RIGHT CHOICE: Dairy free, Soy free, and Gluten Free.